In our recent article “US E-Commerce Trends and Impact of Logistics”, we assess the current state of the last mile fulfillment market and key supply side drivers of eCommerce.

The US eCommerce industry is expected to post 12-14% growth in 2017, from $375B to $420B. At this rate, eCommerce is conservatively expected to account for 14-16% of the entire US retail landscape by 2022.

eCommerce presents a fundamental shift in how consumers shop and how retailers seek to deliver against consumer’s increasing needs. This creates rapidly changing dynamics in the last mile fulfillment market driven by two considerations: i) Forward-deployment and eaches picking of inventory in close to demand, urban fulfillment centers, and ii) Corresponding increase in last mile parcel delivery

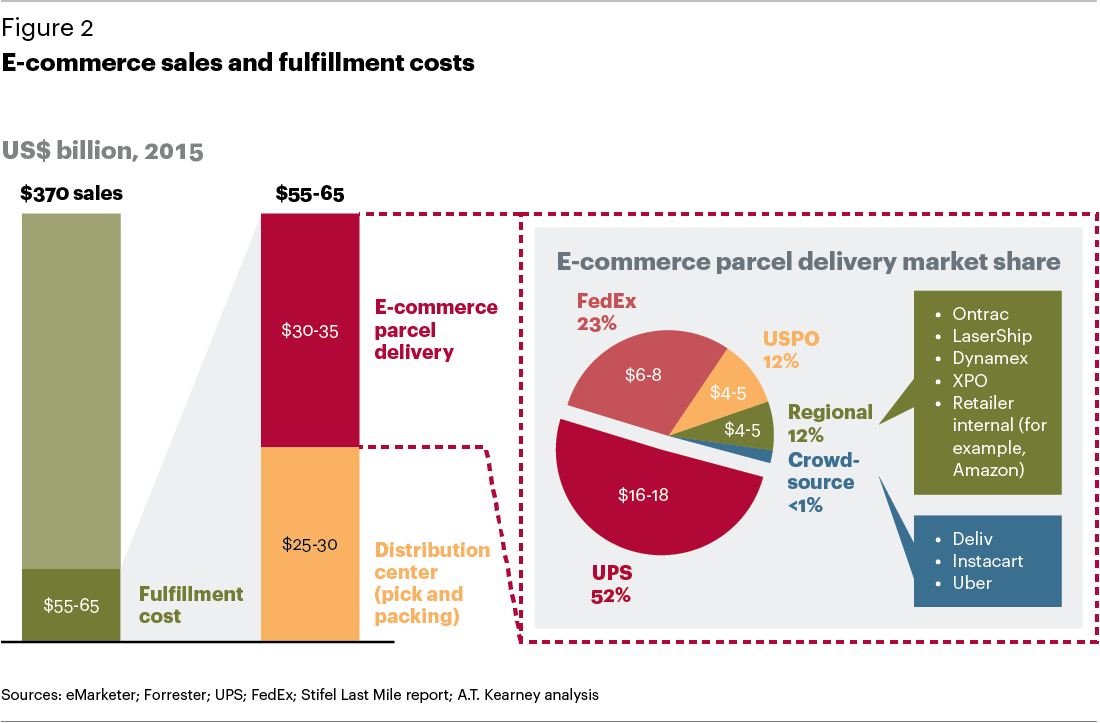

Based on our estimates, U.S. Retailers and Brands spent $60-65B in 2016 on last mile fulfillment. Roughly $30B in fulfillment center picking and packing, and an additional $30-35B in last mile parcel delivery. (see Figure below). Going forward we see several supply side drivers of increasing eCommerce volume.

Three trends driving eCommerce fulfillment

1) Rise of Same-Day Delivery Models. While national parcel carriers (UPS, FedEx, and USPO) account for the majority (85%) of the last mile delivery today, regional last mile carriers such as XPO, Ontrac, TForce, etc. and new crowdsourcing based models like Uber and Deliv are aggressively trying to unlock same day and even 1-hour delivery economics. We continue to see strong consumer expectations growth for same day speed across numerous categories (e.g. Beauty, Fashion, Grocery, etc.) as well as continued interest from retailers in piloting same day deliveries.

2) A.I. Based Forecasting and Replenishment. A.I and machine learning are increasing being adopted by Retailers and Brands to improve their forecasting and inventory replenishment. The ability to effectively anticipate and deploy long tail SKUs accurately is a key barrier today in retailer’s aspiration to forward deployed more inventory for speed while managing working capital trade-offs. We expect to see significant progress on this front in the coming 3-5 years which will enable significantly more inventory deployment and fulfillment closer to demand.

3) Shared Fulfillment Centers: Watch for increased availability of on demand fulfillment center models, where retailers can flexibly rent capacity on a ‘as needed basis”. Companies such as Flexe and Jagged Peak (FlexNet) are integrating cloud based OMS with shared fulfillment center capacity to enable the Airbnb of warehousing to further reduce CapEx hurdles for last mile fulfillment.

Retailers, Brands and Providers alike need to continually scan these supply side drivers and embed rapid experimentation in their future supply chain.

The post originally appeared on my LinkedIn page.

For more details, check out the full whitepaper: “US E-Commerce Trends and Impact of Logistics”

[…] Trends on US eCommerce Logistics https://michaelhu.com/2017/07/09/us-ecommerce-trends-on-logistics/ … #ups #fedex #lastmile #ecommerce #parcel via @mhu_snowcrash […]

LikeLike